By Piero Russo & Oleksiy Danilin, BSRIA.

By Piero Russo & Oleksiy Danilin, BSRIA.

In this series of reports, we highlight key findings of our European Smart Home Market Study which was carried out during 2011 with a view to anticipating how the market will develop over the coming years. We undertook the research by interviewing and exchanging information with the top players and stakeholders around Europe, and the resultant study is the one of the first to comprehensively analyse all of the available knowledge on smart home technologies and generate reliable market data. The project includes nine in-depth reports on different European markets: Germany, France, UK, Netherlands, Belgium, Norway, Sweden, Denmark, and Poland. In this issue, we will summarise the results for Belgium.

The Belgium market is unique given the number of suppliers that co-exist in its three different regions: Wallonia, Flanders and Brussels Capital. There are more than 40 suppliers of smart home systems and products, most of which are very small companies. There are several types of suppliers with distinct products and strategies. The providers of basic systems hold 40% of the market, this includes companies such as Niko (Nikobus), Domestia, and the basic offer from Legrand/BTicino. The suppliers of extended systems hold 50% of the market, this includes companies such as Niko (Home Control), BTicino, Qbus, Teletask, Domintell, Luxom, and the different suppliers that supply KNX systems. Finally, suppliers of high-end, integrated systems aimed at luxury houses or flats, hold the remaining 10%, and these are companies such as Crestron, Vantage and AMX.

Distribution routes are as complex to describe as the number of suppliers is large. While specialist distributors also act as project designers and system integrators, the largest distribution route is via electrical wholesalers, the national ones CEBEO and Rexel as well as the local ones, who will undoubtedly increase the penetration of smart homes among electrical installers and homeowners.

For smart homes, the Belgium market can realistically be divided between Flanders and Wallonia as there is only a limited market for smart homes in Brussels, where a high proportion of occupiers rent their homes. Brussels also accounts for a mere 10% of the number of dwellings present in Belgium. The vast majority of home owners in both Flanders and Wallonia, 93% and 97% respectively, own single dwellings, while in Brussels this is only 49%. These considerations may explain why the market for smart homes is more developed in both Flanders and Wallonia than in Brussels.

It is estimated that the smart home market is taking place primarily in Flanders, at about 70%. This region contains the highest proportion of the population, and also contains the dwellings of good quality, while in Wallonia and mainly around the French border, only 2.3 to 10% of dwellings are of high quality. In Flanders and near Luxemburg this can reach up to 37.7%.

Training is a key feature of the success of leading suppliers in the national market. The sessions are provided by suppliers, and these are attended by electrical installers mostly, who can thus become certified installers of the brand they have chosen to work with. The companies that offer such training include Vantage, Legrand, Niko, Domintell, as well as the KNX Association. This is sometimes supported by the professional associations which run a training centre, Formelec. Other suppliers prefer to add value to their offer by providing the system integration themselves. The forecast is bright for smart home penetration in new dwellings, but this is expected to benefit only the largest suppliers with a handle on the electrical installation market, such as Niko and Legrand/BTicino.

Market Size

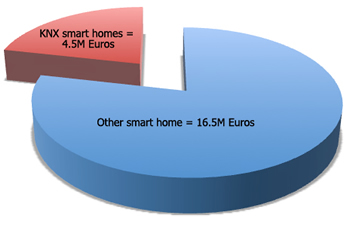

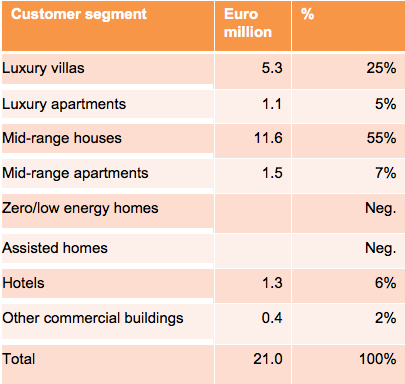

In 2010, the total electrical market in Belgium was estimated at €7.5 billion per year. This includes installation as well as material, products and systems, for both high-voltage and low-voltage networks. As regards the market for smart homes, it was estimated at €21.0 million in 2010, only for products supplied at MSP (Manufacturer Selling Price). This market had been existing for the last 15 years. Since then, it reached a level that can be defined as ‘early adopter’, at the start of the curve corresponding to the diffusion of smart home systems, which has not yet reached its full potential. In the residential market only, the share of KNX systems was estimated to represent approximately €7 million, of which an estimated €4.5 million was in the smart home systems.

The main applications usually found in a smart home installation are lighting, roll-down shutters, blind controls and environmental controls which is expected to grow rapidly in importance. HVAC controls are not always an application that is easy to integrate in a smart home system. Installers of these systems are usually electrical specialists and the integration of the HVAC component within smart home is often not possible for these companies.

For KNX systems, the proportion of installed solutions that integrate HVAC controls is estimated at 20 to 30%.

Basic systems, which are provided by companies such as Domestia and also sometimes by Niko, can support only one application. In this case, the single application that usually applies is lighting control.

Security is sometimes associated with installations of smart home systems. However, due to the legislation that forbids the full integration of such sub-systems with other controls, the integration is often limited to the retrieval of data and handling. It is not possible to send commands to the security system via a smart home solution.

Cost of systems

Smart home systems are expensive, and this acts as a deterrent to most home owners. While the basic smart home system can cost €2,000 to 3,000, prices can escalate, with €6,000 or more for a standard system up to €15,000 for KNX systems and higher for the luxury products.

There are various obstacles to the take-up of smart home technology in Belgium. These include low consumer awareness of product range and functionality, and no real push yet to use smart home technology as a way to improve energy efficiency, added to which the lack of compatibility between smart home systems and heating controls often make integration arduous.

There has also been a history of failure with respect to wireless systems in Belgium, which can affect the retrofit market, and in general, prices remain too high for a standard solution. Finally, the fact that there are three markets in Belgium, with three regions (some say four) means that different approaches and sales teams are required.

On the positive front, economic and construction activity resumed growth in 2010, and there is encouragement from public authorities with a reduced VAT rate for work up to €50,000. More complex dwellings will result in growth of central controls, and there is a trend toward the measurement of energy efficiency and local electricity production. The promotion of quality labels by associations and suppliers will also help, as will the increasing penetration of touchpads in the population, and an increasing number of apps for different platforms (Apple, Android). The population is becoming ever more technically savvy, and as the number of systems that are easy to install increase, so too will adoption. The training of installers is a key factor, as is the involvement of large electrical wholesalers.

Indeed the number of electrical installer companies in Belgium is estimated at 12,000. It is the main access route and source of specification for suppliers of smart home systems in the mainstream market. If more electrical installers can start to promote the concept of the smart home with their clients, some industry experts claim that the market could reach more than twice its current size.

Piero Russo is a Senior Market Research Consultant, and Oleksiy Danilin is an International Research Consultant for BSRIA, a specialist consultancy that offers worldwide market intelligence across a broad range of building infrastructure products and services.

www.bsria.co.uk