Innovation scouting, partnering, collaboration, and appropriate acquisitions are essential for growth, finds Frost & Sullivan’s Home & Building Team

Unambiguous business models, frequent innovations on Internet of Things, cloud services, Big Data platforms, rise of connected devices, and dependency on technology are some of the drivers propelling double-digit growth in the European home automation market.

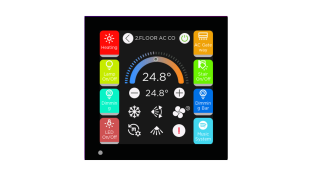

Products and services associated with home automation and smart and connected homes have changed the consumer’s perception of technological innovation. They are being remodelled into a connected and personalised ecosystem of services. Home automation systems (HAS) and solutions have created a home environment whereby seamless experiences and high comfort levels can be achieved, especially in the ‘luxury’ end of the market. Connectivity and response from establishing user-interactive features are becoming high-impact trends, accelerating growth and attracting new entrants with continuous innovation.

Frost & Sullivan’s research, European Home Automation Systems Market, Forecast to 2022, finds that the total European home automation market is estimated to reach $806.1 million by 2022, recording a compound annual growth rate (CAGR) of 15.8%. The study describes how the Internet of Things (IoT) has influenced technologies such as near-field communication, wearable technology, smartphones, and the penetration of Wi-Fi and Bluetooth. Revenue forecasts by country and region, technology trends, and a comprehensive competitive analysis of key players are also provided.

“In the next three to five years, voice-over-technology, gesture, and facial recognition will become the key transformational technologies in the home automation market,” said Frost & Sullivan home & building technology Research Analyst Harini Shankar. “Players should adopt deep and machine learning algorithms as these technologies will become critical to future home automation systems.”

Further trends and developments driving growth and innovation in the European Home Automation Systems Market include:

Emergence of disruptive end-to-end, connectivity, and hub models in the next three to five years;

Partnerships or compatible agreements among original equipment manufacturers (OEMs) and service/platform providers, such as Lutron and Apple Homekit, to deliver an efficient and manageable HAS Product-as-a-Service (PaaS) solution;

Rise of merger and acquisition (M&A) activities due to key companies trying to strengthen their market positions. Examples include Samsung’s acquisition of SmartThings, and AMX Harman and Bosch’s acquisition of ProSyst;

Convergence of home automation market with connected homes market, thereby opening doors for new entrants such as Vivint, Amazon Echo, and Nest;

Development of new business models due to technology innovation and increased connectivity; and

Expansion of brands from the connected home market, such as Samsung, Net, hive, Philips Hue, and Qivicon, into more sophisticated home hubs and converging with the HAS market.

“Innovation scouting, partnering, collaboration, and appropriate acquisitions will be essential to mitigate high initial investment and replacement costs, and lack of skilled labour,” noted Shankar. “Players should seek to deploy easy-to-understand, customer-centric business models to increase HAS market penetration.”

European Home Automation Systems Market, Forecast to 2022 is part of Frost & Sullivan’s Home & Building Growth Partnership Service program. The study segments the home automation market based on its scope as hardware and software. Hardware includes home measuring and monitoring devices, home controller units/master hubs and plug-and-play devices, whereas software includes applications to control and automate home functions. The regional scope of the study covers the United Kingdom, Germany, France, Italy, Spain, Poland, Scandinavia (Denmark, Norway, Finand, and Sweden), Benelux, and Rest of Europe (Switzerland, Ireland, Norway, Portugal, and Austria).