The HMRC in the UK recently published Notice 708: Buildings and Construction – August 2014. For the first time intelligent lighting (not including remote control hand sets) has been recognised as ‘ordinarily incorporated in a building’.

What does this mean in reality? According to Andy Ellis, MD of Household Automation Ltd and long-time campaigner for a change in the VAT rating, “New build properties can now have intelligent lighting, heating and air-conditioning systems installed at 0% VAT.”

Ellis goes on, “Because we deal with a variety of different equipment, it has always been difficult to segregate what is 0% VAT rated. With the issuing of Notice 708 (specifically section 13.8 ‘Examples of articles normally incorporated in a building’ and 13.8.1 ‘Dwellings’) things have become far clearer. My interpretation is now that any part, of any intelligent BUS system used for lighting or heating that is part of a fixed installation can be zero rated for VAT in a new build property.”

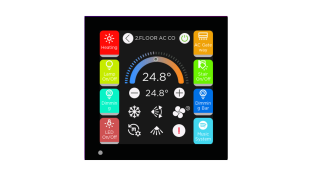

“So as well as the standard components of lighting such as switches and dimmers, items such as in-wall room controllers and touchscreens can be included. With a comprehensive BUS set up, such as KNX, this means that pretty much the whole system can be zero rated, including light fitments and outside lighting.”

With major building construction companies now having to seriously consider a proper technology infrastructure within their properties, the zero rating of intelligent control will surely be a major incentive to specify intelligent systems.

For the full story, see Andy’s blog.