Frost & Sullivan expects convergence of standards to speed up adoption tremendously

The global wireless sensor networks market is highly dynamic with rapid technological developments strengthening their use case in a myriad of applications. Need for real-time data monitoring and analysis in factory automation is the primary driver for wireless sensor networks. End users are also comfortable employing wireless devices for less critical functions such as tracking production flow and quality. Cloud connectivity and development of newer wireless protocols have strengthened deployment of wireless sensor networks in diverse applications.

New analysis from Frost & Sullivan, Global Wireless Sensor Networks Market, finds that the market earned revenues of $1.20 billion in 2014 and estimates this to reach $3.26 billion in 2020 at a compound growth rate of 18.1 percent.

“All industries, apart from consumer electronics and goods, deploy wireless sensor networks for monitoring,” said Frost & Sullivan Measurement and Instrumentation Industry Principal Dr. Rajender Thusu. “The building automation, supply chain, defense, materials handling and food and beverage, sectors use wireless sensor networks for tracking and tagging in addition to monitoring.”

However, wireless sensor networks remain underutilized for control functions, except for short range wireless sensor communications and a few off/on features. Reliability and security appear to be key user concerns. Further, end users are hesitant to invest the time and money required to address currently limited bandwidth.

Lack of convergence is another challenge compounded by proprietary wireless network standards. Enforcement of common wireless sensor network standards will be critical to ensure free data flow, eliminate data packet losses, and sustain pace of transmission.

To meet diverse market needs different approaches have been developed. Wireless devices based on IEEE 802.15.4 are characterized by short range, low bit rate, low power, and low cost. These devices work to connect the physical environment with the real world applications. Other efforts include development of 6LoWPAN which is an Internet Engineering Task Force (IETF) that aims at achieving transfer of IPv6 packets over low-power wireless sensor networks (WSN) based on standards such as IEEE 802.15.4.

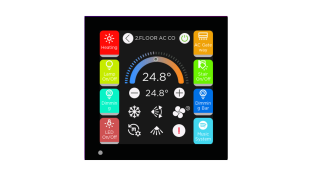

Among proprietary solutions Z-Wave developed by Zensys, focuses on addressing the building automation and smart homes market. Another effort is DASH7 which is an alliance that focuses on sub-1GHz Radio Technology based on the Alliance Mode Protocol, chip development, and device productization. It facilitates interoperability with various standards.

“WirelessHART protocol and ISA100is becoming a common standards across industries,” noted Dr. Thusu. “With a converged standard, end users can easily integrate process control and automation sensors with other functions such as asset and human tracking systems.”

Should convergence stay out of reach, network management tools that enable communication integration at the application level are expected to bridge the gap in the global wireless sensor networks market.

Global Wireless Sensor Networks Market is part of the Sensors & Instrumentation Growth Partnership Service program. Frost & Sullivan’s related studies include: Global Pressure Sensors and Transmitters Market, Global Biosensors Market, Sensors in Power Generation and Smart Grid, World Torque Sensors Market, Global Temperature Sensors Market and Global Sensor Outlook. All studies included in subscriptions provide detailed market opportunities and industry trends evaluated following extensive interviews with market participants.